Linea airdrop...

And key technical signals to watch

GN gents,

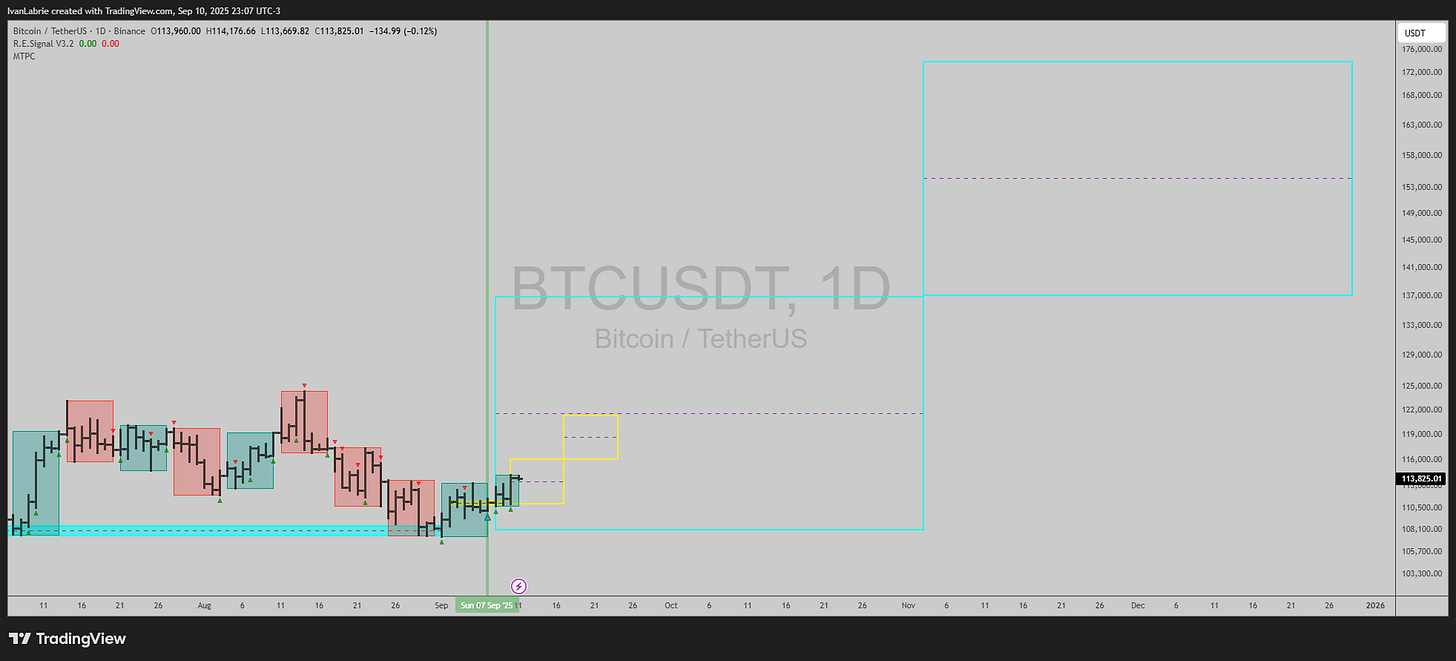

Tomorrow we have to be ready for short term volatility, since the European Central Bank rates decision and CPI data from the US will be released. Once this risk is out of the way, the market won’t pay attention to anything else until FOMC next week, for the most part, so technical signals will be allowed to do their thing without CME traders affecting them with their hedging flows.

Daily chart flashed a new buy signal today in Bitcoin and a weekly trend can trigger this week as well, with upside towards 137k or up to 174k longer term.

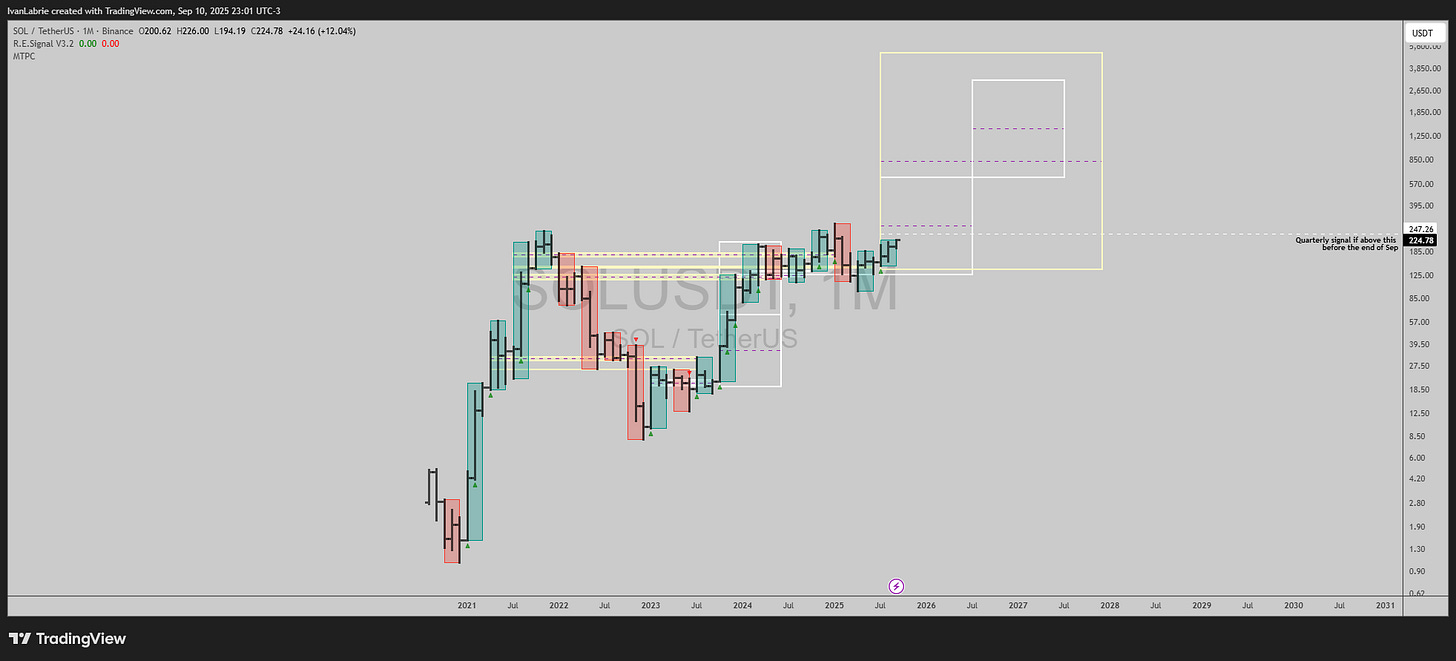

Solana and Hyperliquid have strong daily and weekly trends:

Solana is trending up in all timeframes but the quarterly. Keep an eye on it, if it were to cross over $247.26 before the end of September, then a quarterly signal with $5000 as a target would be active…

For now, monthly calls for $500 to $1500 upside long term.

It appears the worst could be over and long term bullish trends could resume, let’s wait and see, next few days are crucial for the viability of this theory.

Linea airdrop and TGE + Linea Ignition campaign

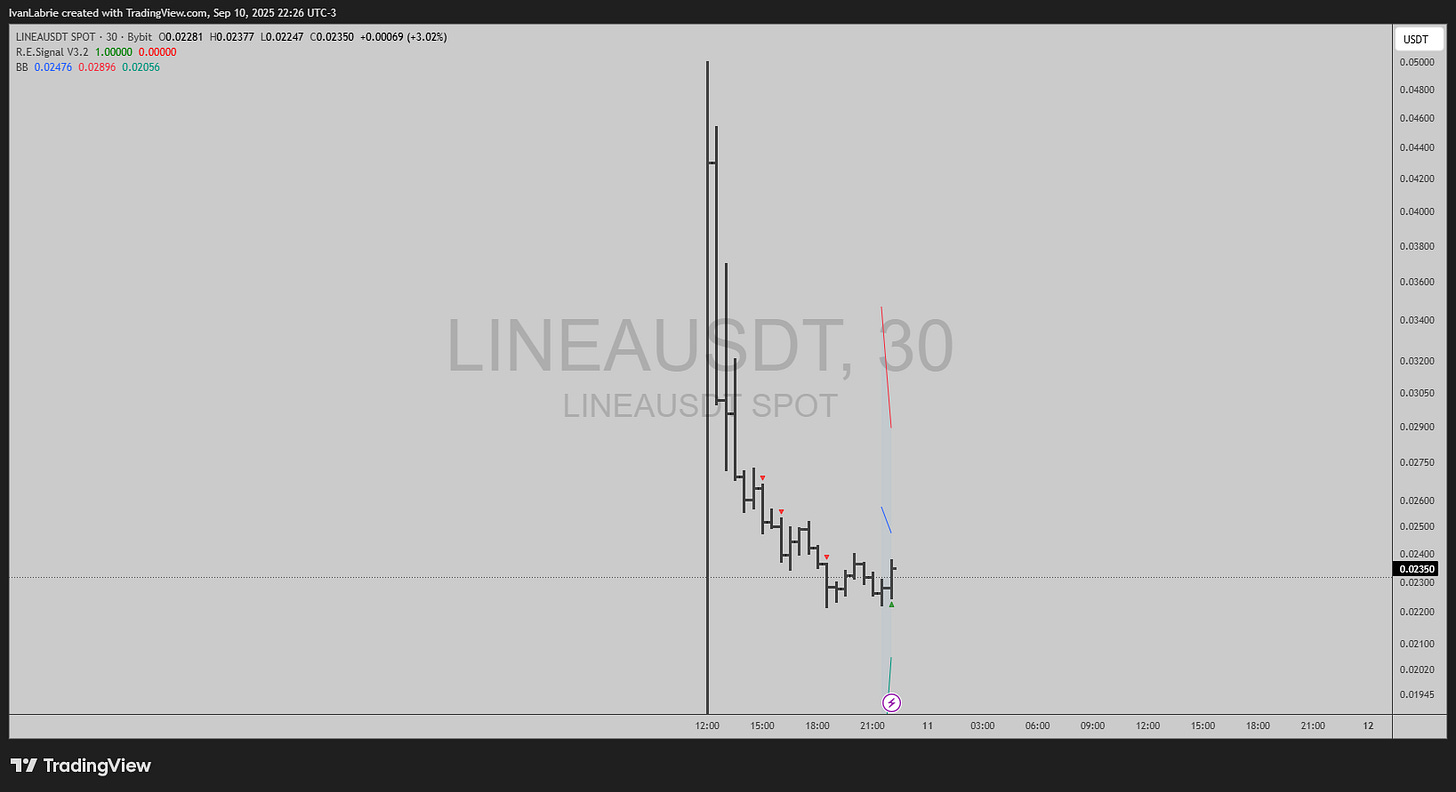

The $LINEA token finally is live, currently basing after selling off since listing (not too shocking given airdrop farmers wanting to sell after a long period of farming).

Link to check and claim your allocation HERE.

Linea, a Layer 2 scaling solution developed by Consensys, has forged a strategic partnership with SharpLink Gaming, Inc. ($SBET, a major Ethereum treasury holder with $3.6 billion in ETH assets).

SharpLink announced plans to stake a significant portion of its ETH holdings on Linea's mainnet, aiming to optimize yields through staking rewards and L2 efficiencies.

This move positions SharpLink as a key institutional backer for Linea, enhancing its liquidity and adoption within the Ethereum ecosystem. Consensys founder Joseph Lubin has described ETH, $SBET, and Linea as "100% Ethereum" assets, emphasizing their interconnected roles in bolstering the network's growth.

The partnership extends to a Linea Consortium co-led by Lubin and SharpLink, involving names like Eigen Labs and ENS Labs, to drive long term development and Ethereum aligned innovations.

The approach aligns with deflationary tokenomics (via fee burns) to enhance long term value, while the Linea Consortium ensures collaborative governance with Ethereum native entities, fostering institutional and developer growth without compromising decentralization.

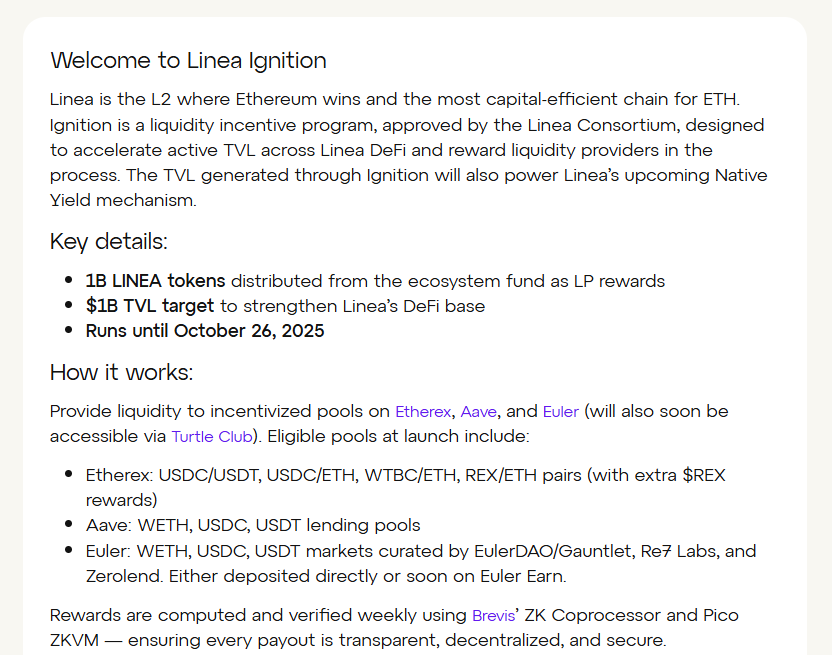

One such initiative is the 10 week long Linea Ignition campaign:

I highly recommend leveraging these opportunities to secure LINEA rewards while simply holding WETH and doing basic DeFi activities you’d normally do anyways.

Read the blog post for more info:

Keep reading with a 7-day free trial

Subscribe to Ivan Labrie’s Substack to keep reading this post and get 7 days of free access to the full post archives.