Brace for downside...

A correction or a top

GM gents,

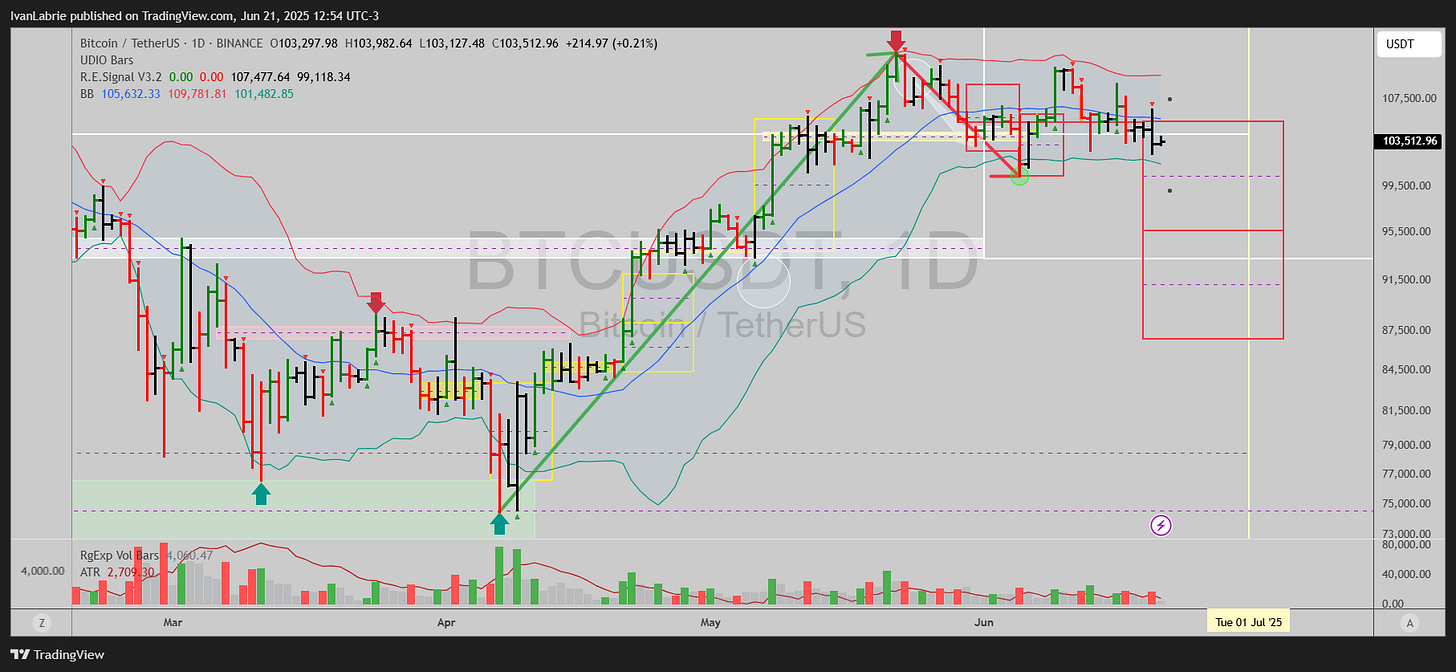

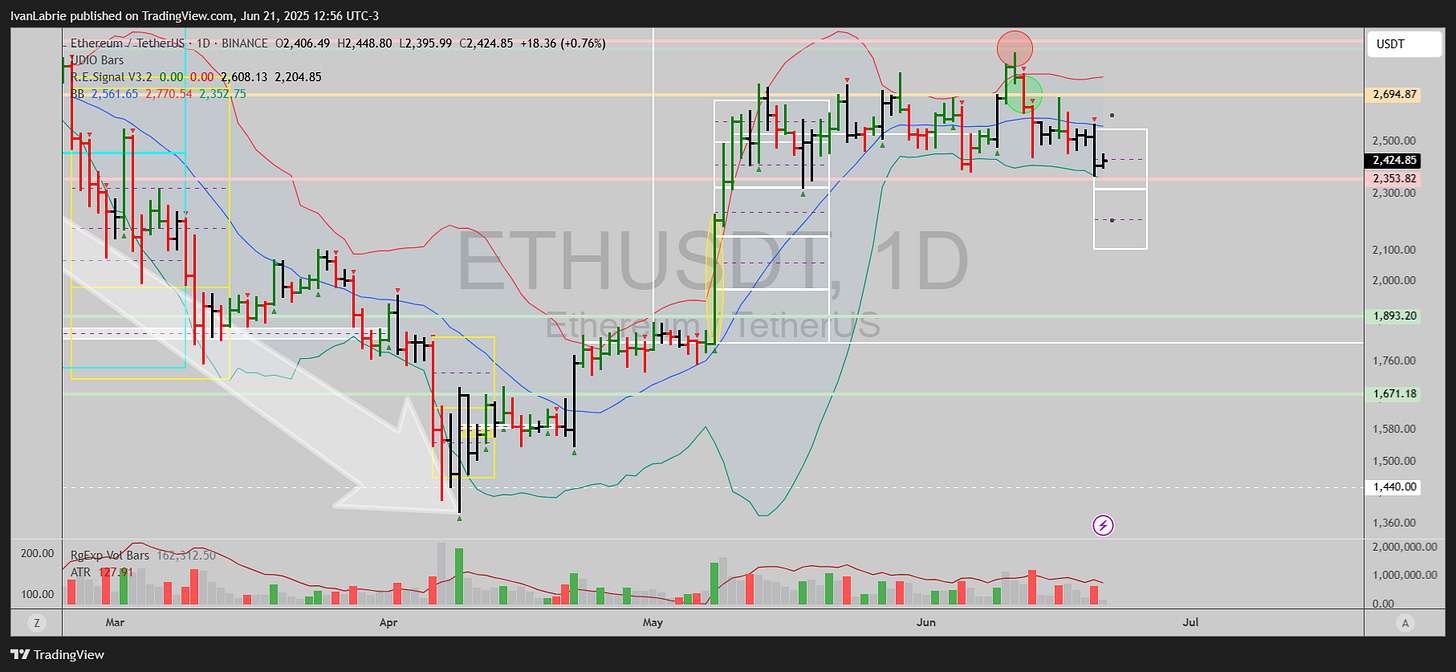

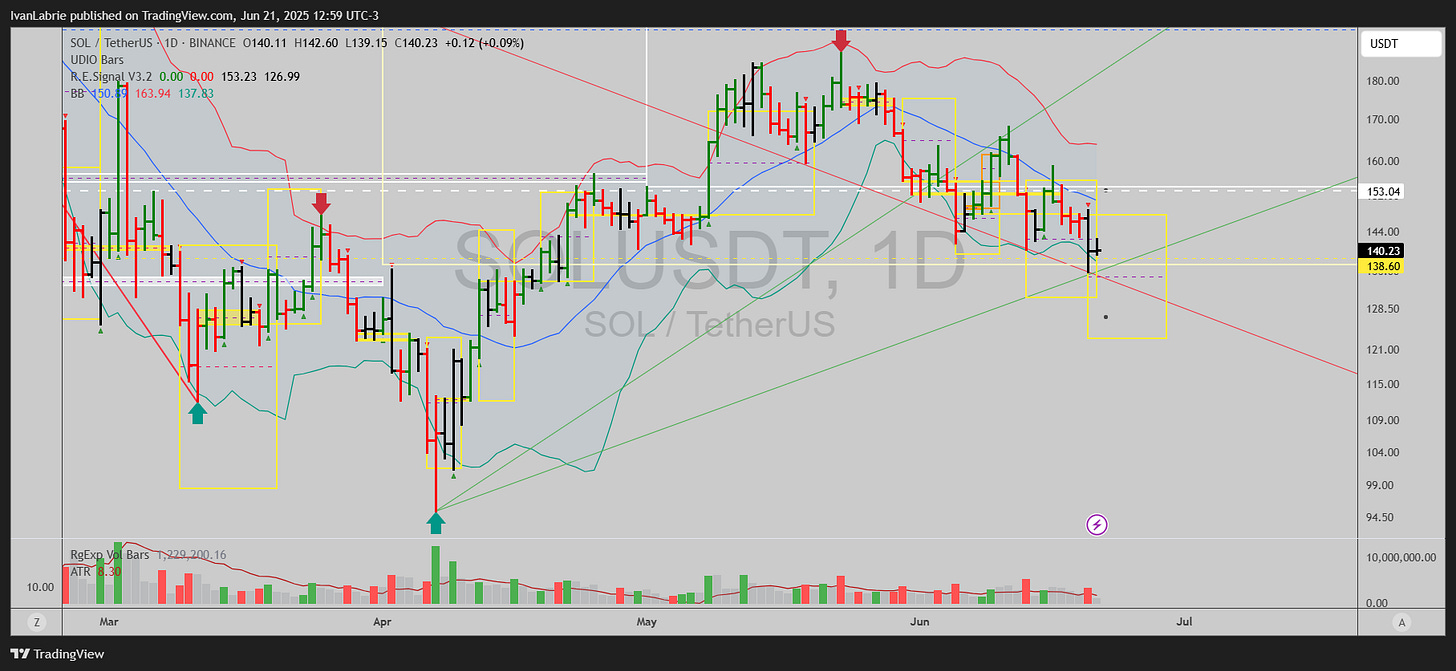

I have some bad news to give you: price action has evolved in a negative manner and fundamentals are not helping us either. Daily timeframe trends are now bearish in all major crypto pairs (BTCUSDT, ETHUSDT, SOLUSDT) and even in ETHBTC, with dominance rallying once more.

This could be either the start of a substantial correction, in case the monthly trends I outlined in my previous post are still at work, or a top.

In such binary and uncertain scenarios, it definitely makes sense to figure out how to contain downside risk. If you adopted my 60/40 and yield farming strategy, you’re good to go overall, if you are more actively trading, you can consider hedging the portfolio and accepting a loss if price breaks over yesterday’s high pretty much.

SOLUSDT turned bearish on May 30th, same as BTCUSDT, but recently price had bottomed on June 5th, and it was possible to base and trend up from here, but that possibility was negated yesterday.

ETHUSDT was the strongest pair, which had ETHBTC acting bullish but now both USDT and BTC pairs flashed bearish reversal signals, and ETH’s once more at risk of falling.

If you can get access to options, you can look into buying 40% delta puts out 1 month for the same amount of notional as you hold in coins, if not, maybe do 1x leverage shorts with crypto collateral, or sell to stables and use proceeds for yield, etc.

This is up to you, the devil is in the details and it depends on your risk tolerance, experience level and activity in markets. A more passive approach given the yearly up trend in Bitcoin, in which case, if you divert some % of your cash flows to investing long term, you’re fine holding and rebalancing on a monthly or quarterly basis as you would usually do with the 60/40 approach.

Long term crypto degens have survived hodling through a couple bear markets by now,. if you can stomach this, then you simply focus on asset allocation for the next 5 years and on generating yield (and maybe airdrops) while managing risk and exposure to smart contracts, custodians, CEXes, etc.

This too shall pass, for sure. You may use margin loans to manage your liquidity needs for expenses, in which case you need to maintain a secure LTV as buffer to weather down turns (10% to 40% max). If exceeded, add collateral or pay off some debt from your crypto bags. Nothing new here…

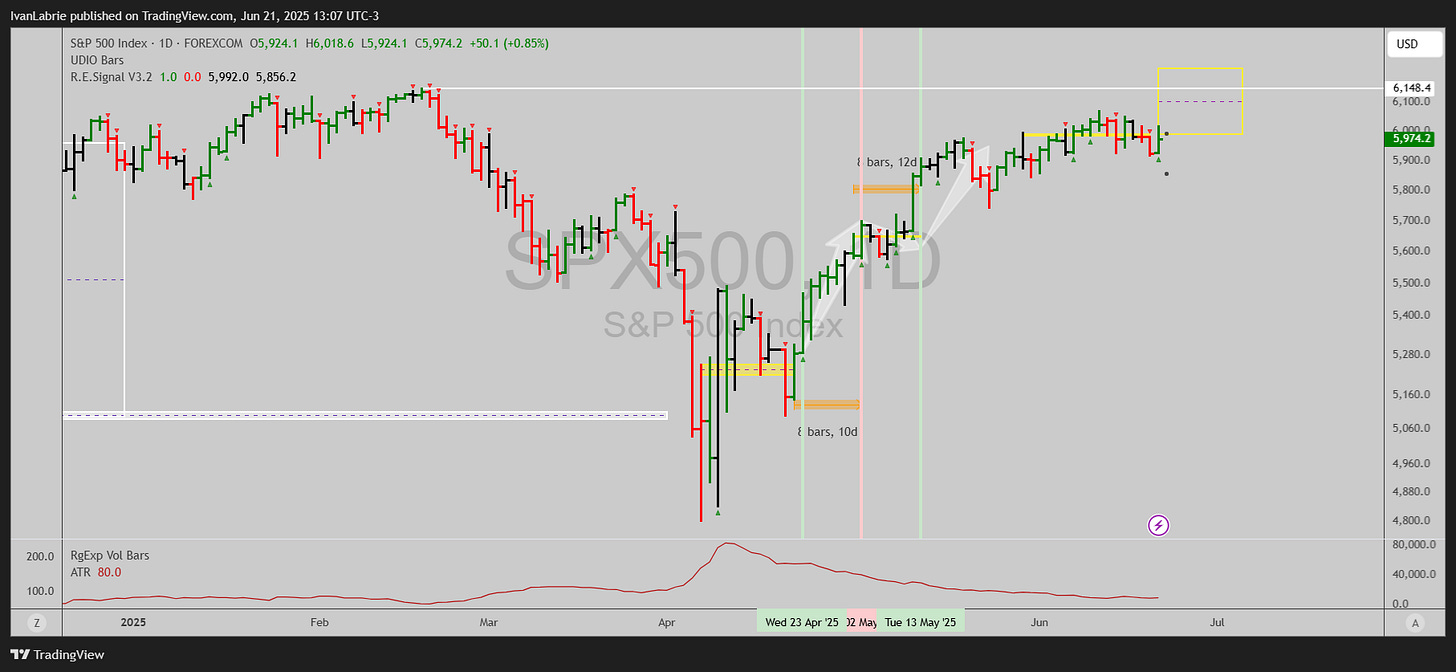

Stock market provides some hopium here…

$SPX500 (or any futures chart) shows that indices might rally from here within the next 2 weeks or so, which is an interesting contrast to the weakness in crypto.

When will crypto stop underperforming stocks?

There clearly is no shortage of buyers, in tradfi circles, be it ETFs, “Bitcoin Treasury Strategy” stocks, etc. who have provided support and probably prevented things from falling even more dramatically if they were absent. Is this simply OGs cashing out?

Gox sellers banking gains cause ‘the coin is worth 100k after all!’?

Whatever the reason, and even with the cash injection from FTX repayments, we still can’t rally further, so this points to massive sell pressure neutering the advance.

Equities have a more mixed bag status but the main names can trend higher as per long term charts, the names behind the AI revolution specially. I think once we get a rate cut things might trend smoothly again, and that might happen sooner than priced in perhaps if Federal Reserve's Christopher Waller is right (he said they "could cut rates as early as July meeting.").

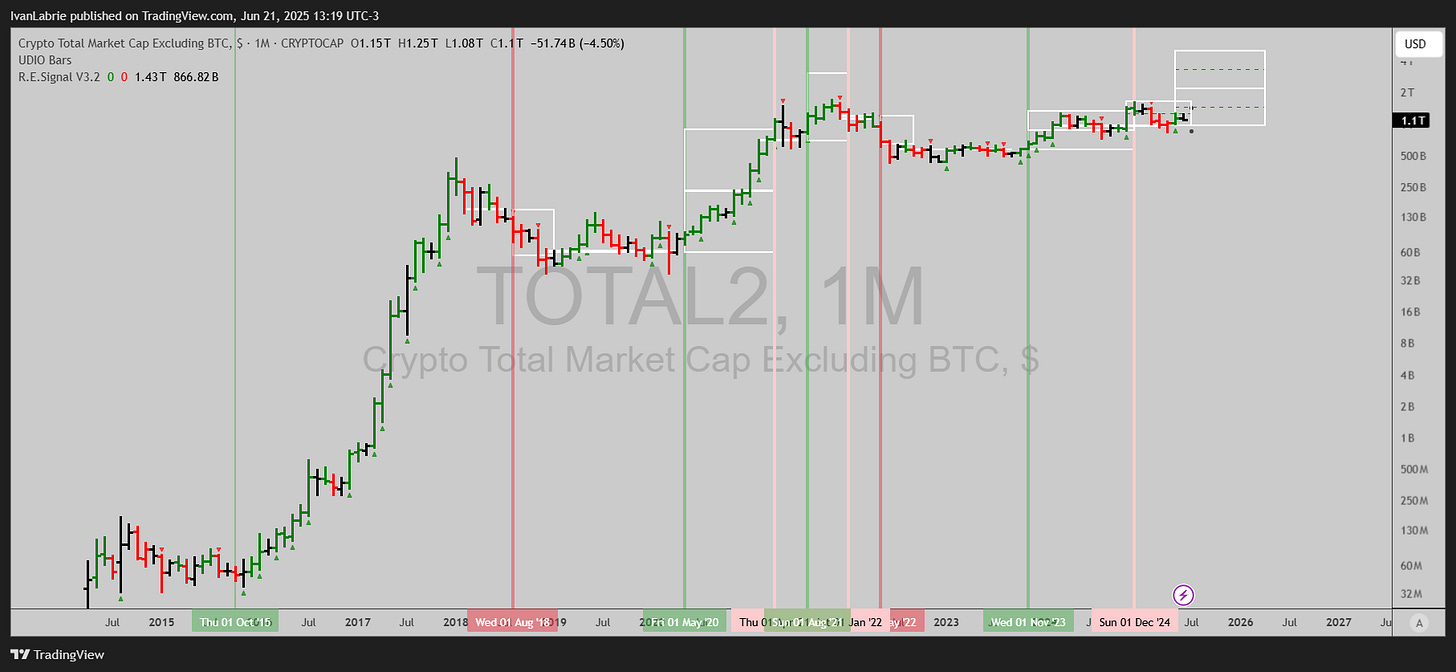

A look at long term charts across crypto

In the short term we face downside risk but a lot of charts suggest things can go higher in the next few months, it’s either a massive trap or things will get better after the current headwinds are out of the way.

Keep reading with a 7-day free trial

Subscribe to Ivan Labrie’s Substack to keep reading this post and get 7 days of free access to the full post archives.