GM gents,

Today I want to break down a few interesting defi opportunities as well as look into a few airdrop updates.

My focus is on generating yield while maintaining 1:1 delta or better vs holding the spot positions I am interested on for the long term here. Not on stables or risking impermanent loss or lower delta vs holding $ETH for instance.

Why?

Because the market is about to stage a massive rally for months, and if we can be long or even surpass the results of simply holding coins, we will do well. (this obviously is not for people following the semi passive 60/40 portfolio, as you’d keep 40% in stable farming ops at all times).

Let’s get started with Ethereum first:

ETH farming ops

As you know, ETH generates cash flow from staking and restaking, which we can amplify with leverage. There’s two different types of approach we can use here, one more conservative (so to speak) than the other:

Supply liquid staked/restaked ETH as collateral to borrow ETH, to then liquid stake/restake, and repeat the loop.

Supply liquid staked/restaked ETH as collateral to borrow USDC to then buy ETH, liquid stake/restake it and do the loop with lending platforms.

The 2nd approach consists of a margin long ETH position with ETH collateral, so it is extra degenerate, but it’s what I’m doing, while carefully managing LTV to stay at 40% or lower at all times (by increasing or decreasing debt). This is not for the faint of heart with lots of experience.

That out of the way, let’s break down how you can leverage defi to amplify staking yield, practically.

There’s two ways to go about this:

Manually utilizing lending platforms and liquid staking/restaking protocols to generate loops and maximize leverage.

Using platforms like Contango which simplify the required transactions, at the expense of increased smart contract risk layers.

Contango

Contango is a useful platform to generate nice yields with leverage in very few clicks. You can filter by size and chains, among other criteria. I show the top 6 yields you can obtain with ETH above, in this case with a 450 ETH position to illustrate the available liquidity and yields with a bit more size. Make sure to not include incentives (that are short lived) in APY ranking calculations by the way.

Pendle: obviously

Pendle offers nice yields on ETH with 0 impermanent loss or leverage, while generating points for future airdrops which might mean increased yield (no way to know how much).

This is a good lower risk option that is always viable. You can also opt for fixed yields to have more predictable outcomes.

On the topic of debt in USDC or ETH, the former allows you to not necessarily outperform or match ETH price performance with your base positions, while getting yield.

Why?

Because, if for example you were to provide liquidity in an automated market making vault, the fact of holding ETH and say USDC or WBTC or whatever other coin, implies that your performance won’t necessarily match the one of ETHUSDT. If so, your debt in ETH becomes a burden and potential liquidation risk over time.

So, if you want to explore other paths outside of leveraged staking/restaking, you should borrow USDC and be wary of downside risk for sizing and maintaining a safe LTV.Beefy

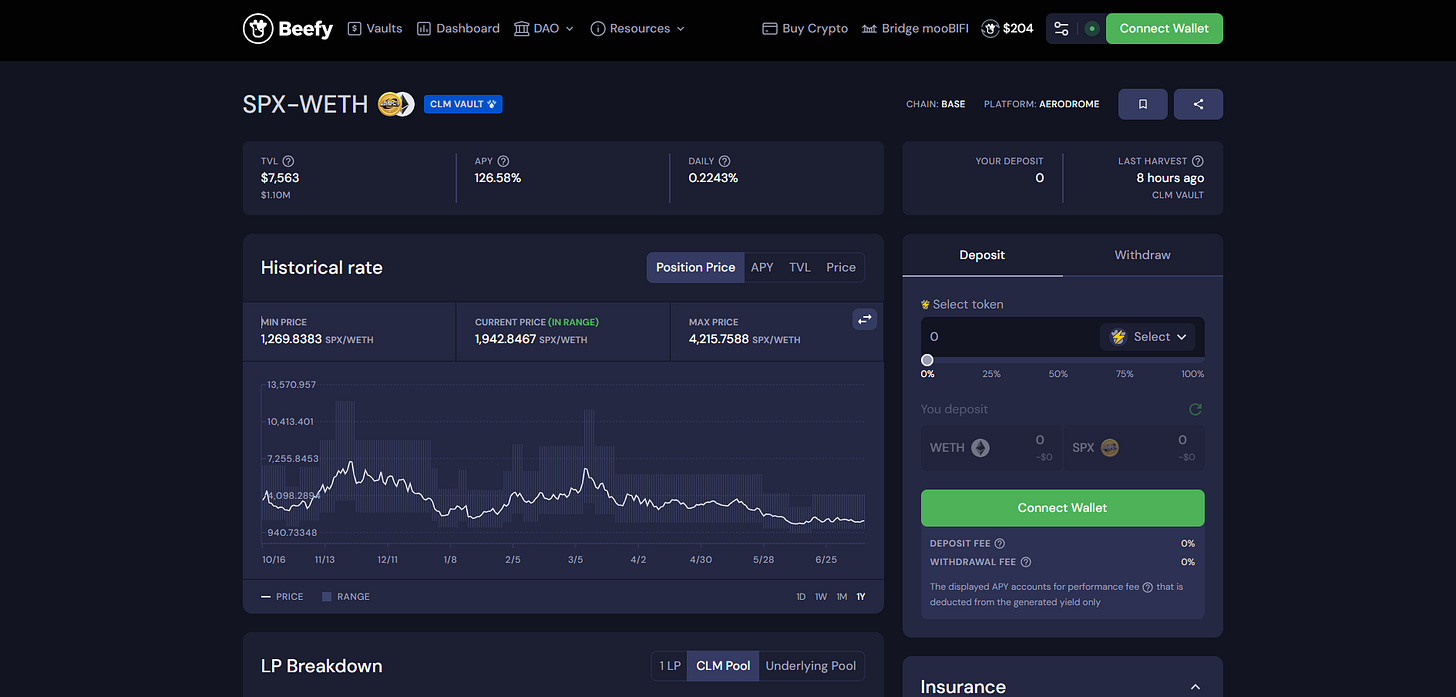

Ok, so you borrowed USDC, swapped for ETH and are ready to generate some high APYs in LP positions, we can leverage platforms like Beefy for automatically maanged LP positions (CLM and CLM vaults). These reduce the impact of impermanent loss at times, and make it simpler to follow these strategies.

No particular pick here, up to you what you choose to use if any, but definitely pick ETH paired with either stables or some other coin you’re bullish on.

HYPE farming ops

I’m farming very few things currently, most of them in the HyperEVM ecosystem. I’ve shared guides to farm it effectively before, but there’s many new things to try.

I bring you two newer DEX platforms we can farm, that have good promise and will be easy for us to score highly on, since they are early and under-farmed now.

Kittenswap was a good farming op, they already distributed airdrop rewards to people who used the platform for some nice extra yield.

These two new platforms are likely to pay off too, when they release their tokens:

Hybra Finance

Hybra Finance is a public liquidity layer on the Hyperliquid blockchain, engineered for high yields and capital efficiency. With over $304M in volume, it utilizes an "Evolved ve(3,3)" incentive model and a partner-aligned bribe system to create a rewarding flywheel for liquidity providers.

For traders, Hybra combines Concentrated Liquidity for tighter spreads with an Intent-Based Execution Layer, delivering fast, one-click, and MEV-shielded trades. This design aims to build a deeply liquid and highly efficient trading environment, positioning Hybra as a core protocol in the Hyperliquid ecosystem.

You can provide liquidity to rack up points, it’s still very early and wise to do so.

Join HERE

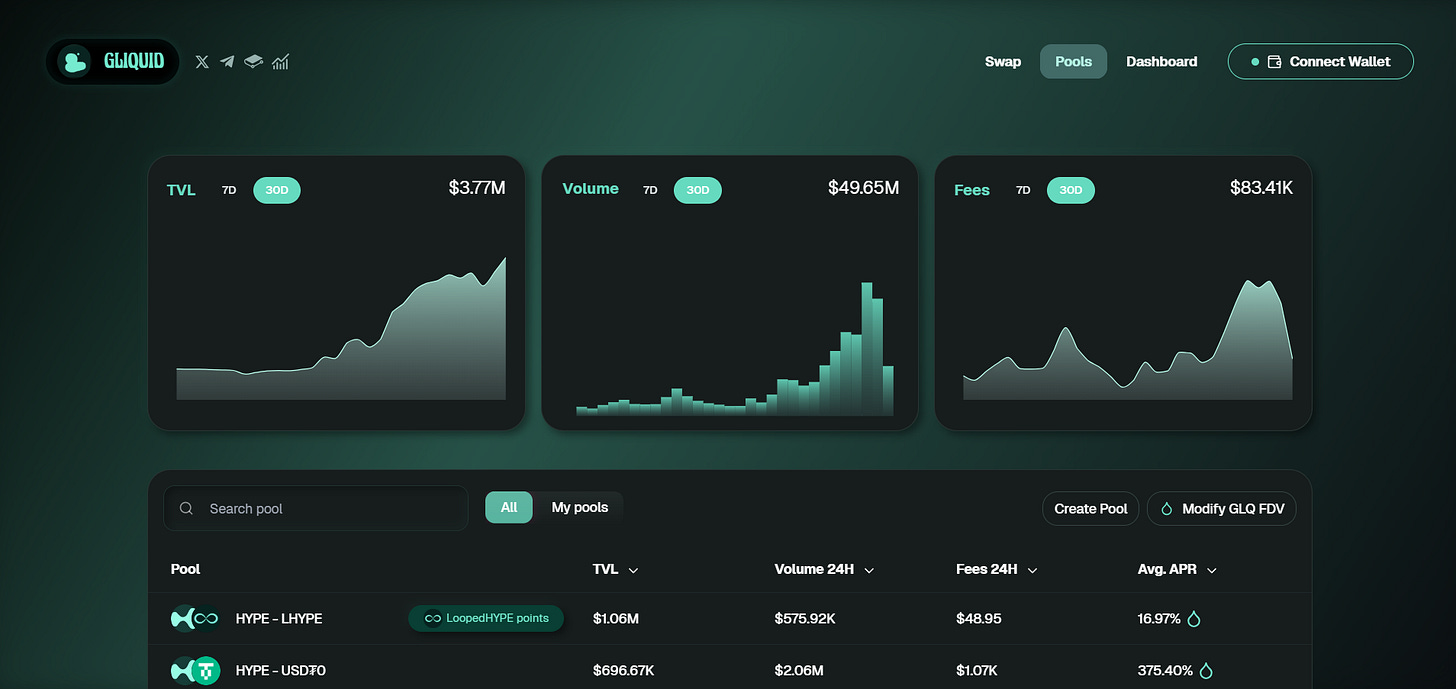

Gliquid

Gliquid is a next-generation V4 AMM on the Hyper EVM ecosystem, using the CryptoAlgebra stack to deliver hyper-efficient liquidity and the lowest price impact for traders. Fully team-funded with no VCs, its mission is to become the leading community-driven decentralized exchange by fostering transparency and collective growth. Gliquid aims to be the preferred platform where community projects, major users, and institutions unite for their liquidity needs.

Once again, if you used HYPE collateral to borrow HYPE to generate yield, you can do LP between LHYPE and HYPE to not underperform HYPE, if you used USDC, you can do LP vs USDT for higher APY and more points.

It’s been amassing TVL quickly since the Kittenswap airdrop and it’s worth a look.

Join HERE

News

Pump dot fun presale sold out quickly, and caused a brief dip in coins people sold to get in. Afterwards, prices rebounded, overall things look constructive for the broad market, this was something that worried me, but it looks like the token itself is not bad news and likely a good thing to monitor for trading opportunities in the future.

Best of luck!

Cheers,

Ivan Labrie.